MP introduces bill to guarantee Canada stays a cash society

Advertisement

Hey there, time traveller!

This article was published 25/06/2024 (304 days ago), so information in it may no longer be current.

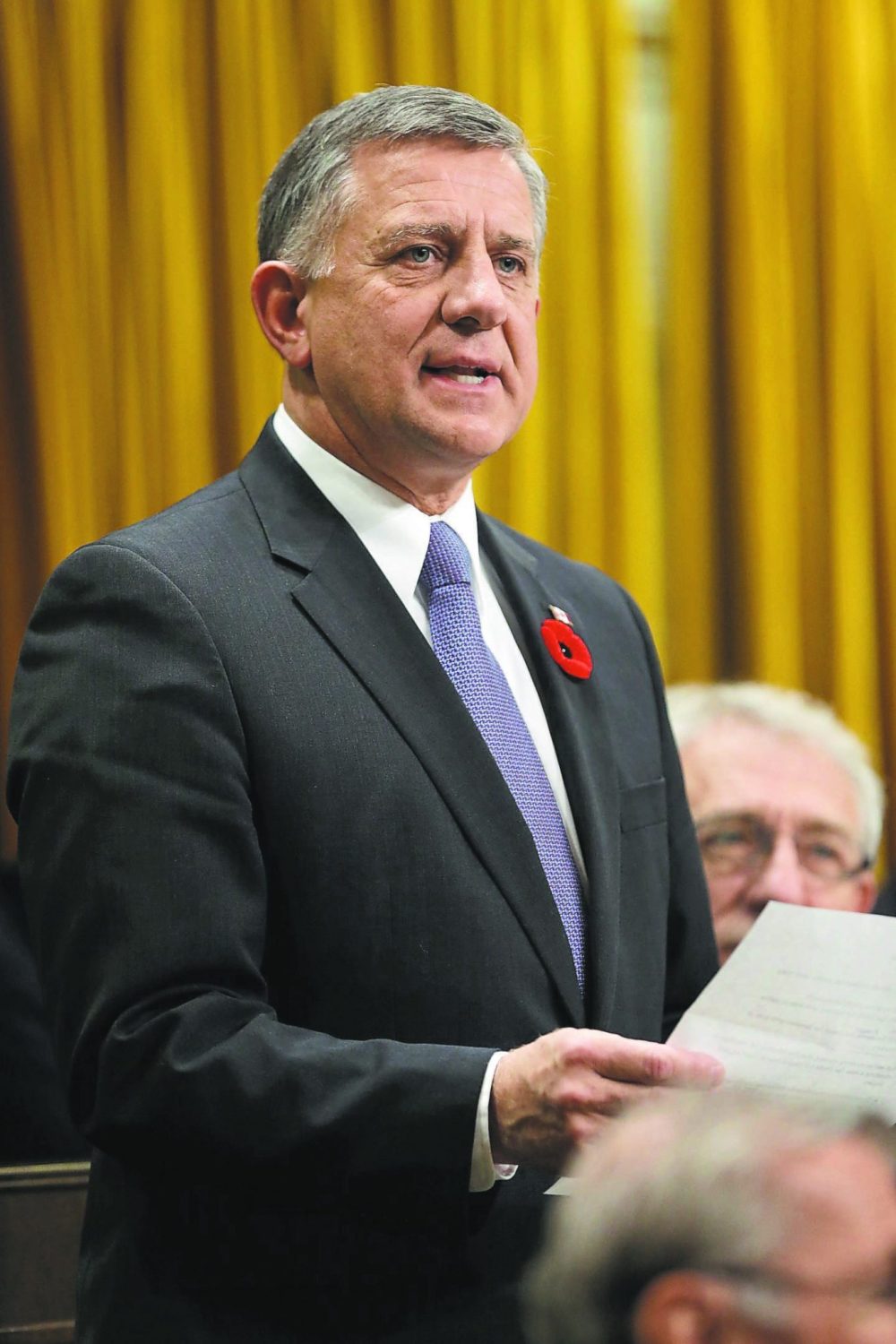

Provencher MP Ted Falk has introduced a bill to parliament that if passed would create a framework to guarantee that Canada stays a cash society.

Bill C-400 would not only guarantee that bank notes and coins are still in circulation, but it would also make an amendment to the Currency Act and the Bank of Canada Act to remove the Governor in Council’s power to call in coins and notes. It also amends the Bank of Canada Act to prohibit the Bank of Canada from issuing a digital form of the dollar.

“I know there’s a lot of people that have mentioned that to me, (in) the years I’ve been here in parliament, (that) have been experiencing more and more people who don’t want to accept cash for payment and yet there’s an awful lot of people that rely on cash,” said Falk.

Falk said people in remote communities, small towns, vulnerable people, seniors, and people who have concerns about privacy rely on cash rather than credit, debit, and digital wallets.

As Falk only introduced the bill on June 13, he doesn’t know what the official position is from the Liberals and the New Democrats, but he said he’s spoken to members from those parties and they seem receptive to his bill.

“It’s not a prescriptive bill where it says you must do this other than that the government needs to come up with a framework that cash is accessible and that it can be used. The other thing that this bill does is it would ban the Bank of Canada from creating a central bank digital currency. The framework would guarantee that there’s bank notes and bank coins.”

Falk said he isn’t against progress. He has concerns though of banks misusing people’s data or the government having control or access to people’s personal financial data.

“The question is from a privacy basis who has access to all that data, because data is what is really important to the credit card companies…we hear more and more people are concerned with banks controlling people’s data. When you use cash, and not everybody wants to use cash, and there are people who like to use cash they should be able to.”